Do not have any account with UOB Kay Hian yet? Open an account with us today.

Visit our investor centre to open your trading account. Our main branch is located at:

| Head Office |

| Ground Floor, Menara Keck Seng, 203, Jalan Bukit Bintang 55100 Kuala Lumpur |

| 8:30am to 5:30pm |

| Mondays to Fridays (excluding public holidays) |

Alternatively, you can also visit any of the UOB Kay Hian branches during their banking hours.

For more information, you can:

Please bring along the following documents:

| Citizenship | Documents Required |

| For Malaysian Citizen | - Identity Card (Blue) - Income Documents* |

| For Malaysian PR | - Identity Card (Red) - Income Documents* |

| For Foreigners | - Valid Passport - Work Permit / Employment Pass (where applicable) |

* Income Documents:- Latest Pay Slip, Latest 3 Months Bank Statement.

Once your application is approved, you will be notified via email to create your own user ID and password to trade online. Register for our UTRADE seminars to learn how to use the UTRADE portal, techniques on fundamental and technical analysis and get trading ideas to start trading.

You can:

1. Contact our E-Business Rep at +603 2147 1900 during operating hours

2. Contact your Trading Representative to enquire about the status of your trading account.

3.Refer to your Welcome Email for step-by-step guide.

4.Self-register online at https://www.utrade.com.my/webecos/agreement.asp

You will receive an email with a link to manually register your own User ID and password for the UTRADE Trading Platform should your trading account is available.

It takes approximately 2-3 working days to process the account opening application, depending on circumstances.

“The CDS acts as a means of representing ownership and movement of securities. CDS account holders enjoy the conveniences of obtaining electronic securities transfer and trade settlement.” – Bursa Malaysia

A CDS account is required in order to buy and sell shares in the Malaysian equities market.

You can refer to the User Guides found on the website on navigation of the UTRADE Trading Platform.

You can also learn more about the UTRADE Trading Platform by attending our platform training seminar held once every month or you can contact our E-Business Rep at +603 2147 1900 to arrange for a one-on-one training.

You are required to visit our any of our respective branches to update your address for your trading and CDS account.

Alternatively, you may dowload the Updating of Account Particulars form and mail the original duly signed form to us.

Your trading account may be suspended from trading if you have been inactive for a long period. Therefore, you are advised to check your account status with your assigned Dealer’s Representative or call 03-2147 1888 for further assistance.

Your CDS account may become dormant or inactive when there has been no transaction entry in the account for at least thirty-six (36) consecutive months from the date of the last transaction.

For further information, please refer to the official Bursa’s website at this link.

You may download and use the Bursa Anywhere mobile application to reactivate your CDS account. For further information, please refer to the official Bursa’s website at this link.

Otherwise, you may submit physical form at our branch offices to reactivate your CDS account. The physical form can be downloaded in the official Bursa’s website at this link.

1. Individual Account Application Form

- Refer here for Terms and Conditions/ Risk Disclosure Statements/ Covenants and Undertakings.

2. CDS Account Opening Form / Update of Account Particulars

3. Form W-8Ben

4. Customer Maintenance Update Form

5. Entity / Individual Tax Residency Self-Certification Form

1. Corporate Account Application Form

- Refer here for Terms and Conditions/ Risk Disclosure Statements/ Covenants and Undertakings.

2. CDS Account Opening Form / Update of Account Particulars

4. Customer Maintenance Update Form

5. Entity / Individual Tax Residency Self-Certification Form

e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

An e-Invoice contains the same essential information as traditional document, for example, the details of the supplier and buyer, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

SST is applicable to Malaysia Incorporated Company that falls within the scope of SST Registration Category.

Client should declare NIL if not applicable.

However, if client is within the scope of SST registration category and did not provide the number, the trading account will be suspended.

i. Tax Identification Number (TIN): C7866136060

ii. Buyer’s Registration (Business Registration Number): 199001003423

iii. SST Registration Number (if applicable): P11-1808-32000111

Do not have any account with UOB Kay Hian yet? Open an account with us today.

Visit our investor centre to open your trading account. Our main branch is located at:

| Head Office |

| Ground Floor, Menara Keck Seng, 203, Jalan Bukit Bintang 55100 Kuala Lumpur |

| 8:30am to 5:30pm |

| Mondays to Fridays (excluding public holidays) |

Alternatively, you can also visit any of the UOB Kay Hian branches during their banking hours.

For more information, you can:

Please bring along the following documents:

| Citizenship | Documents Required |

| For Malaysian Citizen | - Identity Card (Blue) - Income Documents* |

| For Malaysian PR | - Identity Card (Red) - Income Documents* |

| For Foreigners | - Valid Passport - Work Permit / Employment Pass (where applicable) |

* Income Documents:- Latest Pay Slip, Latest 3 Months Bank Statement.

Once your application is approved, you will be notified via email to create your own user ID and password to trade online. Register for our UTRADE seminars to learn how to use the UTRADE portal, techniques on fundamental and technical analysis and get trading ideas to start trading.

Step 1: Access our homepage at www.utrade.com.my

Step 2: Click "Login" button which located at the top right area of the webpage.

The UTRADE Trading Platform will automatically prevent someone from logging into the system if an incorrect user ID or password is used. Please take note of the following:

- The caps lock, as the password is case sensitive.

- You have keyed in the correct user ID and password.

For your protection, your Online Account will be blocked after five unsuccessful login attempts.

Please click "Forgot Password / Unblock Account" to unblock your Online Account

Click here for further details on how to unblock account.

i. Please click Forgot User ID? to retrieve your Online Account User ID.

Click here for further details on how to Forgot User ID.

ii. Please click "Forgot Password / Unblock Account" to reset your Online Account Password.

Click here for further details on how to Reset Password.

As there are inherent risks involved when trading online due to the nature of the Internet, we endeavor to have the best and most up-to-date methods of security when it comes to your transactions within the UTRADE Trading Platforms.

There are some of the security features we have in place to protect your online trading include:

- Multiple Firewalls

All information from clients' computers via the Internet is sent for safety checks before arriving to the internal systems to ensure

that only authorized messages and transactions enter the servers. It also serves to prevent hacking into our trading systems.

- 256-bit SSL Encryption

To protect your data from being tampered with during transmission, all information exchanged on the secure pages are encrypted

using the 256-bit SSL encryption. Any data that you send will be scrambled into an unrecognized form before it is transmitted to our server.

For more information on the SSL encryption technology, please visit here

- Intrusion Detection System (IDS)

The IDS provides 24x7 network security surveillance and proactively prevents security breaches to guard our websites and systems against intrusion.

- Unique User ID and Password

You are identified uniquely by your user ID and can only log into the secured portions of the system with your password.

Transactions will only be authorized with your valid user ID and password.

- Log out before exit the browser

To ensure that you close the session successfully, you should always log off by clicking "Logout" on the top right corner before closing the browser.

- Ensure you have the latest browser

With the latest browser version, you will have the more up-to-date security features.

- Clear your cache after each session

When you login to the UTRADE Trading Platforms, temporary files are stored in your system's cache. You can clear your cache after each session by following these steps:

- Avoid sharing or using shared / public computers

Sharing or using shared or public computers to access UTRADE Trading Platforms is a potential security risk on your part. If you use a shared or public computer, ensure that you disable AutoComplete, log out, and clear your cache after your session.

- Ensure adequate security if on a wireless network.

Be certain that the wireless network has been configured to incorporate network security, including but not limited to, data encryption.

- Check your account regularly

Always check your order history regularly to ensure that all details are updated and there has been no unauthorized access to your account. Please inform us immediately if you suspect unauthorized access on your account.

- Regularly update your contact details.

Keep us updated on your latest contact details to facilitate us in contacting you when necessary.

- Protect your computer against malicious viruses.

You are advised to install and update anti-virus software. Do not install software programs from an unknown source. Certain viruses and programs may capture sensitive personal data without your knowledge. You can prevent this by constantly updating your anti-virus software and regularly scanning your system.

- AutoComplete Disabled.

The AutoComplete function has been disabled to minimise unauthorised access into the system.

- Create strong passwords that are 8 to 15 characters long and include a combination of uppercase and lowercase alphabets, numbers, and special characters. Avoid simple passwords that can be easily guessed. Here are some examples of password combination for your reference:

Fuqinmuqin1$ (12 characters)

Kecikmolek1$ (12 characters)

SuperTrader88$ (14 characters)

@JalanSelatan1 (15 characters)

- Please note that UTRADE password is case-sensitive, so be sure to check your Caps Lock key before entering your password.

* Note: UOBKH will never request for clients to disclose their passwords under any circumstances.

When the information provided is different from the data associated with your Online Account, the Reset Password/unblock Account/Forgot User ID process will not be accepted. Please contact your authorized Dealer’s Representative if your registered Mobile or Email have changed.

Malaysia

Trading at Bursa Malaysia from Monday to Friday, except on public holidays and other market holidays (when the Exchange is declared closed by the Bursa Malaysia Committee)

| Trading Phases | Time | |

| 1st Session | Pre-Opening | 8:30am |

| Opening and Continuous Trading | 9:00am | |

| Closing | 12:30pm | |

| Break | 12:30pm - 2:00pm | |

| 2nd Session | Pre-Opening | 2:00pm |

| Opening and Continuous Trading | 2:30pm | |

| Pre-Closing | 4:45pm | |

| Trading at Last | 4:50pm | |

| Closing | 5:00pm | |

* Note: All unmatched orders during the first session will be automatically carried forward to the second session and shall be considered as valid for the whole trading day.

Singapore

Monday - Friday

| Session | Singapore Time |

| Pre-opening | 0830 – 0859* hrs |

| Non-cancellation | 0858* – 0859 hrs |

| Continuous Trading | 0900 – 1200 hrs |

| Mid-Day Break Pre-opening | 1200 – 1259* hrs |

| Non-cancellation | 1258* - 1300 hrs |

| Continuous Trading | 1300 – 1700 hrs |

| Pre-closing | 1700 – 1705** hrs |

| Non-cancellation | 1704** - 1706 hrs |

| Trade at Close | 1706hrs to 1716 hrs |

| (from 3 June 2019) | (Order submission to be based on closing auction price) |

| Note | |

| Time Period | Remarks |

| * Pre-open phase | Ends randomly at any time from 0858 - 0859 hrs / 1258 - 1259 hrs and Non-cancellation phase will begin immediately after Pre-open phase ends. |

| ** Pre-close phase | Ends randomly at any time from 1704 - 1705 hrs and Non-cancellation phase will begin immediately after Pre-close phase ends. |

For half trading day, Pre-Close routine will end randomly between 1204 hrs and 1205 hrs, i.e. Non-Cancel period can start any time between 1204 hrs and 1205 hrs.

Visit SGX website for more information on trading hours and Trade at Close.

Hong Kong

HKEx operates from Monday to Friday (except on Saturday, Sunday and Public Holidays) during the following hours:

| Time Range | Session |

| Pre-Opening Session | |

| Pre-opening | 0900 – 0915 hrs |

| Pre-order Matching | 0915 – 0920 hrs |

| Order Matching Period | 0920 – 0928 hrs |

| Blocking | 0928 – 0930 hrs |

| Continuous Trading Session | |

| Morning Trading | 0930 – 1200 hrs |

| Break^* | 1200 – 1300 hrs |

| Afternoon Trading | 1300 – 1559 hrs |

| Closing Auction Session | |

| Calculation and Dissemination of Reference Price | 1600 – 1601 hrs |

| Order Input Period | 1601 – 1606 hrs |

| Non-cancellation Period** | 1606 – 1608 hrs |

| Random Closing** | 1608 – 1610 hrs |

^New order submission and amendment made between 1200 hrs to 1300 hrs will be sent to the exchange at 1300 hrs.

* Order cancellation request made between 1200 hrs to 1230 hrs will only be sent to the exchange at 1230 hrs.

** New at-auction orders and at-auction limit orders must be between the lowest ask and highest bid of the order book.

For more details on Hong Kong trading hours and order types applicable to the different session, please click

Hong Kong Exchange website.

Note: For half trading day, Pre-Close routine will end randomly between 1208 hrs and 1210 hrs,

i.e. Non-Cancel period can start any time between 1206 hrs and 1208 hrs.

Hong Kong Shanghai (SSE) and Hong Kong Shenzhen(SZSE)

Monday - Friday

| Session | Shanghai (SSE) | Shenzhen(SZSE) |

| Singapore Time | ||

| Opening Call Auction | 0915 - 0925 hrs | |

| Continuous Auction (Morning) | 0930 - 1130 hrs | |

| Continuous Auction (Afternoon) | 1300 - 1500 hrs | 1300 - 1457 hrs |

| Closing Call Auction | Not applicable | 1457 - 1500 hrs |

| Note | ||

| Time Period | Remarks | |

| 0920 - 0925 hrs | SSE/SZSE will not accept order cancellation | |

| 1457 - 1500 hrs | SZSE will not accept order cancellation | |

| 0910 - 0915 hrs; 0925 – 0930 hrs; 1255 – 1300 hrs |

Orders and order cancellations can be accepted but will not be processed by SSE/SZSE until the respective market open | |

| Orders that are not executed during the opening call auction session will automatically enter the continuous auction session. | ||

US

NYSE, NASDAQ, AMEX and NYSE ARCA operate from Monday to Friday (except on Saturday, Sunday and Public Holidays) during the following hours:

| US (Eastern) Time | 0930 - 1600 hrs |

| Singapore Time | 2230 - 0500 hrs (Standard Time) |

| 2130 - 0400 hrs (during *Daylight Saving Time) | |

We do not participate in extended hours trading (pre-open and post-market).

* To adjust for Daylight Saving Time, the US market hours will move 1 hour forward from the second Sunday of March to the first Sunday of November.

Orders will be routed for processing from 0830 hrs (Eastern Time) onwards. In accordance to US trading rules , no cancellation or amendment is allowed between 0928 hrs to 0930 hrs (Eastern Time).

As there is no minimum or maximum bid size check, do exercise cautious during your order submission. If you have entered a higher buying price or a lower selling price than the opening/prevailing price, your order will be executed based on the prevailing market conditions.

Australia

Monday - Friday

| Australia Time |

10:00^ hrs to 16:00 hrs (Normal Trading Hours) 16.00 hrs to 16.10 hrs (Pre-Closing Single Price Auction) 16.10 hrs to 16.12 hrs (Closing Single Price Auction, i.e. Order Matching) |

| Non-Daylight Saving Malaysia Time |

08:00 hrs to 14:00 hrs (Normal Trading Hours) 14:00 hrs to 14.10 hrs (Pre-Closing Single Price Auction) 14:10 hrs to 14:12 hrs (Closing Single Price Auction, i.e. Order Matching) |

| *Daylight Saving Malaysia Time |

07:00 hrs to 13:00 hrs (Normal Trading Hours) 13:00 hrs to 13.10 hrs (Pre-Closing Single Price Auction) 13:10 hrs to 13:12 hrs (Closing Single Price Auction, i.e. Order Matching) |

Some counters may be displayed under Top Volume during pre-opening hours (8.30am – 8.58am), due to reporting requirements for married trades executed after trading hours.

Theoretical Opening Price (TOP) allows investors to have a half hour ‘viewing period’ before the market opens in the morning and afternoon session. For example, trades and the theoretical opening price for each counter can be seen from 8.30am until 9am before the market starts to trade. This scenario is also applicable for the afternoon trading session. This feature allows investors to better analysis the market sentiment and share performance due to the transparent pre-opening period.

Day - Day orders expire automatically if not matched or canceled on the trading day that it is placed.

Good-Til-Date (GTD) – GTD orders remain active until a user-specified date, unless it has been matched or canceled.

Limit Order (For HKEX) - A limit order will allow matching only at the specified price. The sell order input price cannot be made at a price below the best bid price, if available whereas the buy order input price cannot be made at a price above the best ask price, if available. Any outstanding limit order will be put in the price queue of the input price.

Counter party information tells you who the brokers that matched your SGX trades are.

Equilibrium price is the price at which orders would be executed if pre-opening/pre-closing matching were to occur at that point and acts as an indication of the eventual opening or closing price. SGX publishes this data on a real-time basis to provide more market transparency and helps market participants assess the market and adjust their orders accordingly. Masking of all better bid/ask prices and quantities acts as an additional safeguard against manipulation of the eventual equilibrium price.

In the US market, ticker symbols are used to uniquely identify stock names.

Ticker symbols are modified with suffix letters indicating the status of the stock. In some cases, it includes corporate actions or other aspects unique to the trading of the stock.

View list of commonly used suffix letters:

| Q: | Bankruptcy reorganisation issue. |

| E: | Issue with deficient or late filing with the SEC. |

| SP (Special): | Indicates that some unusual condition exists for the security. |

| RT (Rights): | Represents the privilege to subscribe, in proportion to the number of shares owned, to new or additional stocks, usually at the market price. Rights have their own market value and can be actively traded. |

| WI (When Issued): | Indicates a transaction in a stock authorised for issuance, but not yet actually issued. The transactions are on an “if” basis, to be settled if and when the actual stock is issued. |

| WD (When Distributed): | Indicates a transaction in a stock authorised for distribution, but not yet actually distributed. The transactions are on an “if” basis, to be settled if and when the actual stock is distributed. |

SGX

The minimum bid sizes are shown below.

SGX stocks (excluding preference shares), Real Estate Investment Trusts (REITS), business trusts, warrants and any other class of securities.

| Share Price (S$) | Bid Size (S$) | Bid Range |

| Below 0.20 | 0.001 | +/- 30 bids |

| 0.20 to 0.995 | 0.005 | |

| 1.00 & above | 0.01 | |

For example, if ABC shares were last traded at S$3.360, the price range to enter will be calculated to be +/- 30 bids from S$3.360. In this case, the price range will be $3.060 and S$3.660. Orders entered out of this range will be rejected as a mitigating control for any error trade.

HKD-denominated stocks on SGX

| Share Price (HK$) | Bid Size (HK$) | Bid Range |

| Below 0.25 | 0.001 | +/- 10 bids |

| 0.25 to 0.495 | 0.005 | |

| 0.50 to 9.99 | 0.01 | |

| 10.00 to 19.98 | 0.02 | |

| 20.00 to 99.95 | 0.05 | |

| 100.00 to 199.90 | 0.10 | |

| 200.00 to 499.80 | 0.20 | |

| 500.00 & above | 0.50 | |

JPY-denominated stocks on SGX

| Share Price (¥) | Bid Size (¥) | Bid Range |

| Below 2,000 | 1 | +/- 10 bids |

| 2,000 to 2,995 | 5 | |

| 30,000 to 49,950 | 50 | |

| 50,000 to 99,900 | 100 | |

| 100,000 & above | 1,000 | |

Others

| Class of Security (S$) | Bid Size (S$) | Bid Range |

| ETFs and Debentures | 0.01 or 0.001 as determined by SGXST | +/- 30 bids |

| Bonds, and Loan Stocks | 0.001 | +/- 30 bids |

| Bonds and Loan Stocks quoted in the $100 price convention (including SGS Bonds) |

0.001 | +/- 1000 bids |

BURSA

You can key in share prices for an order of up to +/- 30 cents (for share price below RM1.00) or +/- 30% (for share price more than RM1.00) from the previous day's closing price. The share price bid sizes are shown in the table below. Bursa Malaysia shall enforce Price Thresholds for all securities traded. The upper and lower price limits set for the whole trading day are as below:

Share price bid sizes, limit up and limit down

| Share Price | Bid Size | Upper Limit Price Threshold for Existing Share | Lower Limit Price Threshold for Existing Share |

| Below RM1.00 | 0.5 sen | 30 sen | 30 sen (subject to minimum price of 0.5 sen) |

| RM1.00 up to RM9.99 | 1 sen | 30% | 30% |

| RM10.00 up to RM99.98 | 2 sen | ||

| RM100.00 and above | 10 sen | ||

For bonds, debentures, loan securities, warrants and call warrants, the minimum bid structure has the same minimum trading spreads as for shares.

ETF bid sizes

| Securities | Share Price | Bid Size |

| ABFMY1 | At any price | 0.1 sen |

| Equity-Based ETFs | Less than RM1.00 | 0.1 sen |

| RM1.00up to RM2.995 | 0.5 sen | |

| RM3.00 and above | 1 sen | |

Example 1:

If the Reference Price is RM0.06, the limit up price will be RM0.36 (RM0.06 + RM0.30) and limit down price will be RM0.005 (system minimum price).

Example 2:

If the Reference Price (i.e. the Last Traded Price on previous day or last trading day) is RM1.14. The upper limit price will be RM1.48 (i.e. 30% of RM1.14, round downward to the

nearest bid size). The lower limit price will be RM0.80 (ie 30% of RM1.14, round upward to the nearest bid size).

No orders shall be entered above the upper limit or below the lower limit during the trading day.

HKEx

The share price bid sizes are shown in the table below.

| Share Price | Bid Size (HK$) |

| From $0.01 to $0.25 | 0.001 |

| Over $0.25 to $0.50 | 0.005 |

| Over $0.50 to $10.00 | 0.01 |

| Over $10.00 to $20.00 | 0.02 |

| Over $20.00 to $100.00 | 0.05 |

| Over $100.00 to $200.00 | 0.10 |

| Over $200.00 to $500.00 | 0.20 |

| Over $500.00 to $1,000.00 | 0.50 |

| Over $1,000.00 to $2,000.00 | 1.00 |

| Over $2,000.00 to $5,000.00 | 2.00 |

| Over $5,000.00 to $9,995.00 | 5.00 |

The share price bid sizes for Exchange Traded Funds are shown in the table below.

| Share Price | Bid Size (HK$) |

| From $0.01 to $ 1.00 | 0.001 |

| Over $1.00 to $5.00 | 0.002 |

| Over $5.00 to $10.00 | 0.005 |

| Over $10.00 to $20.00 | 0.01 |

| Over $20.00 to $100.00 | 0.02 |

| Over $100.00 to $200.00 | 0.05 |

| Over $200.00 to $500.00 | 0.10 |

| Over $500.00 to $1,000.00 | 0.20 |

| Over $1,000.00 to $2,000.00 | 0.50 |

| Over $2,000.00 to $9,999.00 | 1.00 |

The share price bid size for debt securities are as follows:

| Share Price | Bid Size(HK$) |

| From $0.50 to $9,999.95 | 0.05 |

HK-Shanghai/Shenzhen Stock Connect

Minimum bid size is CNY 0.01. Shares traded on the SSE/SZSE are subject to a price limit based on their previous closing price, including a ±10% price limit for stocks under normal circumstances and a ±5% price limit for stocks that are under special treatment (i.e. ST and *ST stocks) under risk alert.

HKEx has put in place a dynamic price checking for buy orders. Buy orders with input prices lower than the current best bid (or last traded price in the absence of current best bid, or previous closing price in the absence of both current best bid and last traded price) beyond a prescribed percentage will be rejected by the Exchange. HKEx has set the dynamic price checking at 3% during the initial phase and may be adjusted from time to time subject to market conditions.

During Opening Call Auction, the current bid (or previous closing price in the absence of the current bid) will be used for checking. During Closing Call Auction, the current bid (or last traded price in the absence of the current bid) will be used for checking. Dynamic price checking will be applied throughout the trading day, from the 5-minute input period before the start of Opening Call Auction until market close.

US Markets

| Share Price | Aggressive Price Away Limit | Passive Price Away Limit | |

| Less than US$25 | 10% | 100% | |

| US$25.01 to US$50 | 5% | 100% | |

| Above US$50 | 3% | 100% | |

If a current bid or ask is not available, then the most recent quote is used to calculate the limit threshold.

Example:

1. If the current bid price is at $15.00, then a sell order at $13.45 (Aggressive price) will be rejected because it is more than 10% limit threshold.

2. If the current ask price is at $30.00, then a buy order at $31.60 (Aggressive price) will be rejected because it is more than 5% limit threshold.

IMPORTANT REMINDER:

As there is no minimum or maximum bid size check, do exercise cautious during your order submission. If you have entered a higher buying price or a lower selling price than the opening / prevailing price, your order will be executed based on the prevailing market conditions. You must always check your UTRADE order status for the latest order status.

For further details, please click this link.

Australia

| Share Price(AUD) | Minimum Bid Size (AUD) |

| Less than A$0.10 | 0.001 |

| A$0.10 to A$1.995 | 0.005 |

| Above A$2.00 | 0.01 |

| Order Submission | Restrictions |

| Price | Up to 10% from Best Bid or Offer Price (E.g. If the current bid price is at A$15.00, then a sell at A$13.45 (Aggressive Price) will be rejected due to exceeding 10% limit threshold) |

| Quantity | Up to 30% of the average of the last 20 days of trade |

| Value | Up to USD 1m for each submission |

Please contact your Trading Representative / E-Business Representative for assistance.

Bursa

The minimum number of shares you can place in an order is one lot. The lot size, which is determined by the respective Exchange, will be displayed on the Place Order page after you have selected the stock.

| Foreign Exchanges | Singapore | Hong Kong | US & Australia | SSE & SZSE |

| Minimum Share | 1 Lot = 100 units | Lot size is based on counter | 1 Lot = 1 unit | 1 Lot = 100 units |

Bursa

The maximum number of shares you can place in an order is 500,000 shares. For orders greater than 500,000 shares, please enter multiple orders in smaller quantity.

| Foreign Exchanges | Singapore | Hong Kong | US & Australia |

| Maximum Share | 5000 Lot = 500,000 units | 500 Lot = 500,000 units | 500 Lot = 500,000 units |

Bursa

Odd lots placement can be done online when you access the UTRADE trading platform using web browser only.

SGX, HKEX and SSE & SZSE

Odd lots placement cannot be done online. Please contact your Trading Representative for odd lots order placement.

US & Australia

You can trade with minimum number share of 1 unit.

You can place new order for the next trading day at the following time.

All overnight orders are subject to trading limit check on next trading day. You are advised to check the order status from time to time.

| Market | Time | ||

| Bursa | After 17:15 hrs (Malaysia Time) | ||

| SGX | After 23:59 hrs (Malaysia Time) | ||

| HKEX | After 23:59 hrs (Malaysia Time) | ||

| HK- SSE/SZSE Connect | After 23:59 hrs (Malaysia Time) | ||

| US | After 11:59 hrs (Malaysia Time) | ||

| ASX | After 23:59 hrs (Malaysia Time) | ||

Yes, for shares listed in Bursa Malaysia, please ensure that your shares are in your UOBKH Securities (M) Sdn Bhd designated CDS sub-account. If your Malaysian shares are held with other stockbroking houses, please arrange with your other broker to transfer the shares into your UOBKH Securities (M) Sdn Bhd designated CDS sub-account.

For SG, HK and US shares, please ensure that the shares are in your UOBKH online account before selling them via UTRADE multimarket trading platform.

UOBKH Securities (M) Sdn Bhd to other custodians charge RM10 per counter

Share transfer is immediate.

Yes, you will be notified.

You will need to go to your existing Broker to request for a transfer or shares. Please complete the Transfer In of Foreign Securities From Other Broker form and mail it back to us. For more information, please contact our CDS & Settlement Department at +604 229 9318.

Agents for American Depositary Receipt (ADR) issues for the imposition of a custodial fee to holders, to be collected by the ADR agent.

The usual practice is for the ADR agent to deduct the custodial fee from the gross dividend payable to the ADR holders.

In turn, we will deduct these ADR fees from dividends due to clients or otherwise a debit advice will be sent to clients seeking their payment. Rate applied will be approximately USD0.02 per ADR.

The ADR custodial fees are imposed by DTC and is irrevocable and not subject to waiver.

Under the IDSS framework, investors will be able to sell securities first and buy the securities later within the same trading day itself.

IDSS can be carried out on a selected List of Bursa Approved Securities. The list will be reviewed and revised by Bursa Malaysia periodically.

You are required to fill in and submit the forms to your dealer representative:

Please download the form here.

Your UOB Kay Hian trading account will not have access to IDSS by default. (Please refer to Question 3)

It is not applicable to:

It is best to close the short position by 4:30PM. Reason is because the market will enter into matching time (pre-closing), if you have not closed the position before 4:45PM, you might not be able to buy back your short selling shares by 4:59PM, because after 4:50PM to 4:59PM is trading at last, all stocks are to be traded at last price.

Yes. All IDSS position MUST BE CLOSED OFF during the day.

If IDSS was failed to be closed off on same day, you will need to inform your dealer’s representative to carry out any one of the following actions unless you have the shares in your CDS account with UOBKH:

Notes:

Initiation of share borrowing – RM400.00 per initiation

Interest rate for share borrowing – 2% to 15% p.a. + Company’s cost of fund on the Mark to Market (MTM) value of the borrowed shares

Transfer fee – RM31.80

Debit Note will be raised on T+4 to charge on borrowing cost

70% of the Client’s Trading Limit;

Client’s buy limit will automatically be increased by the IDSS amount

The increase in buy limit is meant for client to buy back IDSS shares

Cash Up Front Account

Collateralised Account

Normal Account

There is no additional fee. The brokerage fees vary depending on the type of the trading account. You may contact your dealer representative for more information.

The symbol of "^" represents IDSS securities. It will appear right beside the stock name on live quote.

IDSS Symbol ("^")

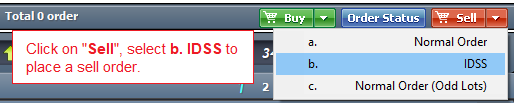

New Order Type for IDSS

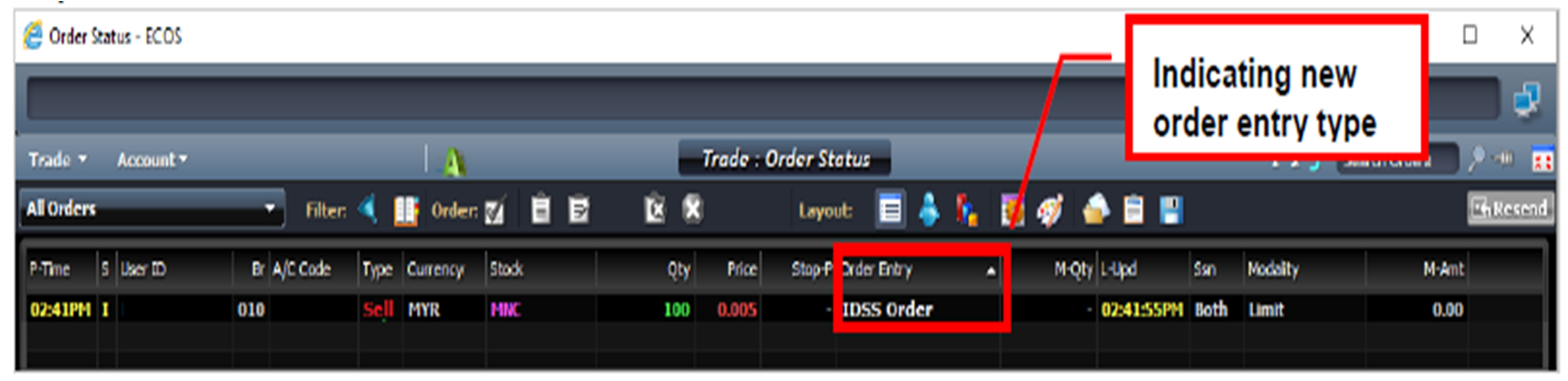

Order Status Screen for IDSS

Malaysia

Commission (Online):

| All Contract Types | Collaterised Account | Cash Upfront Account |

| Contract Value up to RM100,000 | 0.30% | 0.10% |

| Contract Value above RM100,000 | 0.20% | 0.10% |

| Intraday | 0.10% | 0.10% |

| Minimum Commission | RM8.00 | |

| Other Charges | ||

| Clearing Fee | 0.03% on gross consideration (Maximum of RM1,000) | |

| Stamp Duty | For "shares or stock" - the stamp duty is RM1.00 for every RM1,000 (or fractional part) of the transaction value of securities (payable by both buyer and seller). The stamp duty shall be remitted to the maximum of RM1,000 with effective from 13 July 2023 until 12 July 2028. For "marketable securities" - the stamp duty is RM1.00 for every RM1,000 (or fractional part) of the transaction value of securities (payable by both buyer and seller). The stamp duty shall be remitted to the maximum of RM200 with effective from 1 Jan 2022 until 31 Dec 2026. |

|

SG, HK, US, AU and SSE & SZSE markets

Commission (Online):

| SGX | HKEX | SSE &SZSE | ASX | US | |

| Contract Value < RM100,000 | 0.42% | 0.20% | |||

| Contract Value > RM100,000 | 0.30% | ||||

| Minimum Brokerage | SGD20 | HKD100 | CNY48 | AUD30 | USD15 |

| Stamp Duty | For "shares or stock" - the stamp duty is RM1.00 for every RM1,000 (or fractional part) of the transaction value of securities (payable by both buyer and seller). The stamp duty shall be remitted to the maximum of RM1,000 with effective from 13 July 2023 until 12 July 2028. For "marketable securities" - the stamp duty is RM1.00 for every RM1,000 (or fractional part) of the transaction value of securities (payable by both buyer and seller). The stamp duty shall be remitted to the maximum of RM200 with effective from 1 Jan 2022 until 31 Dec 2026. |

||||

Settlement period is a duration in which the ownership transfer of securities takes to complete.

| Exchanges | Settlement & Sales |

| BURSA Malaysia | T+2 |

| SGX, HKEX, ASX & LSE | T+2 |

| US (NASDAQ, NYSE, AMEX & NYSE ARCA) | T+1 |

| CHINA -SSE/SZSE | T+1 |

You can check under 'My Account', one day after trading date to identify contract amount and due date of your trade.

BURSA Malaysia and Foreign Shares - Ringgit Malaysia (If do not opt for Multicurrency Settlement, all the trades will be automatically settled in RM.)

You can choose to deposit using one of the following method:

i. FPX transfer in UTRADE platform (Webpage or Mobile Application)

(Please note that FPX transfers will be processed automatically during Bursa trading days from 8:30 AM to 1:00 PM and 1:30 PM to 6:30 PM.

Any FPX transfers made outside of these hours will be processed during the next Bursa trading day's operating hours.)

ii. Internet banking to our designated bank account

| Bank | Account No | |

| Maybank | 5070 1300 2860 | |

| Public Bank | 3133 431 011 | |

| UOB | 1723 046 667 | |

Please note that only MYR is accepted via Internet banking/cheque.

The sales proceeds from selling shares will be received on the settlement day as depicted in table below. However, the fund can only be withdrawn one (1) Bursa Trading day later.

| Exchanges | Settlement & Sales |

| BURSA Malaysia | T+2 |

| SGX, HKEX, ASX & LSE | T+2 |

| US (NASDAQ, NYSE, AMEX & NYSE ARCA) | T+1 |

| CHINA -SSE/SZSE | T+1 |

Yes, for shares listed in Bursa Malaysia, you may do so if both sales and purchases are in the same settlement currency. Please inform your Dealer Representative of your request one day before the due date of the sale(s).

However, for SG, HK and US shares, every purchases and sales proceed will be settled in separate events.

You may withdraw your trust balance through the UTRADE trading platform in webpage or mobile application.

In webpage, please click My Account -> Trust Withdrawal Application -> 'Go' button -> Withdrawal.

In mobile application, please click Menu -> Withdrawal -> Trust Withdrawal.

Please take note that withdrawal request will be processed in batch, and the cut-off time is 10am on Bursa trading day. Submitting withdrawal before cut-off time may allow your fund transfer to be completed on the same day. (However, the fund transfer may be delayed to next Bursa trading day, subjected to the bank processing time.)

Yes, margin financing is available. Please contact Helpdesk at 03-2147 1900 so that we can further assist you.

Your exchange rates are booked at spot rates based on the instruction given by either your Trading Representative or yourself. You can either refer to the contract note or call your Trading Representative to check on the actual exchange rate.

| Exchange | Amalgamation of Contracts (Yes / No) | |||

| BURSA, SGX, HKEX, ASX | Allowed | |||

| US, SSE & SZSE, LSE | Not Allowed | |||

This charges is subject to applicable prevailing service tax and the securities units balances is inclusive of any securities irrespective of listing status at Bursa Malaysia.

-Refer here for the charges of Bursa CDS Custody Fees.

For shares listed in Bursa Malaysia, orders placed online are automatically contra on a first-in-first-out basis. However, please note that our in-house policy is that all contra trades have to be done by T+2.

There is no contra for Singapore, Hong Kong and US trades.

We/our foreign broker do not provide nominee services for handling IPO application.

Yes, you will receive email notification from UOB Kay Hian except for dividend, AGM or EGM. If client do not respond within the stipulated timeline given, the default action will be taken.

You may give instruction to your Dealer's Representative.

The reason is to allow sufficient time to process and compile client's instruction for submission to registrar.

No, you are not allowed to sell on the market if you have given instruction to accept the offer. We will temporary remove your holdings to avoid short selling position.

Yes, you must have sufficient funds in your trust account for acceptance of these corporate exercises.

Your request will be rejected should there be insufficient funds in your trust account.

Yes, you may set off the charges of different currency by using MYR. Please liaise with your Dealer's Representative upon application.

The new share/cash will be credited into your account 3 - 4 business days after the closing date. However, it is subject to Registrar processing the crediting.

Please refer to respective country exchange website for details.

Singapore - https://www.sgx.com/securities/company-announcements.

Hong Kong - https://www.hkexnews.hk/index.htm.

Australia - https://www2.asx.com.au/markets/trade-our-cash-market/historical-announcements.

US (NASDAQ) - https://www.nasdaq.com/market-activity/.

Thailand - https://classic.set.or.th/tsd/en/tsd.html.

Indonesia - https://idx.co.id.

Log into your UTrade> E-documents> E-Foreign Statement.

You are advised to archive Foreign Shares Statement as the statement will be stored in Utrade platform up to a certain period, subject to UOB Kay Hian¡¯s management policy.

The process may take 1-2 weeks after the submission of instruction.

The receipt can be found in your Utrade account, at UTrade> E-documents> EDebitCreditNote.

Yes, your application will be rejected by the registrar based on the proration of the offer.

Yes, you will be refunded for the fund subscription. However, the handling charges is non-refundable.

The difference is due to foreign currency exchange rate whenever the settlement charges is quoted in MYR.

Yes, there will be ADR charges for non-US companies which is listed in US Exchange.

No, it depends on the counter declaration to the Authorities.

Yes, there will be charges for custodian and safekeeping fees for foreign shares other than US, SGX & HKEX share.

No, we will only inform clients of the original shareholding as per ex-date.

Kindly inform your Dealer's Representatives immediately for instruction if there is an inward transfer or purchase of Rights Share from the market after the entitlement date.

Yes, you may refer to your respective Dealer's Representative or call 03-2147 1888 for further details.

No, you are not allowed to transfer or receive delisted foreign share

It usually takes up to 7 business days for the share transfer to be credited upon receiving a completed form and payments made for the transfer.

However, the standard duration taken for shares to be credited can be delayed due to the process time of transferring broker.

Yes, CBO transfer is only accepted if the transferor and transferee are immediate family members.

Yes, you may transfer the foreign share to or from your joint securities account to individual securities account held by either yourself or other joint account holder. However, you may check with your Dealer's Representative for Foreign Exchange regulations that govern this type of transfer.

Local share - RM10 per counter

Foreign share - RM15 per counter

You need to update the securities account of the deceased to an estate account before a transfer request can be made.

The documents such as NRIC/Grand of Probate/Death Certificate must be certified by Commission of Oath/Notary Public/Lawyer.

Yes, you are able to transfer or receive the share as long as it is tradable.

The OTC share can be received as long as it is not under the pink sheet counter category and the market capitalization must be more than 50 million and the share price must be more than USD0.50.

No, you are not able to transfer or received those US shares that fall under PTP list. You may refer to your respective Dealer's Representative.

Due to IDX regulations, CBO transfer is not allowed even for deceased account.

Not allowed due to restriction imposed by their regulation.

No, you are only allowed to deposit the share after it is officially listed.

No, you are only able to deposit via DRS after the share is converted into NYS or NAS.

A minimum of 14 business days are required for the share to be credited into your account.

You will be notified via email; hence, please ensure your email address is updated.

The standard process time take up to 4 weeks for you to receive the share certificate, subject to processing time of Share Registrar.

Change in Beneficiary Owner for physical deposition is not allowed.

No, as our US agent no longer accept US physical certificate.

You need to contact the company transfer's agent (which can be found either on the front or back of your certificate). Alternatively, you could get the information from the company's website under "Investor Relations" or search online by entering the company name and "transfer agent".

You are advised to contact the Share Registrar to consolidate into 1 (ONE) share certificate as the handling charges for physical deposition is charged per certificate.

Dividend will be credited into your trust account within 7 business days after the payment date.

Log into your UTrade> E-documents> E-CreditDebitNote.

You are advised to archive as the information is only displayed for 1 month.

No, except for Chinese H-share listed in HKEX. The 10% withholding tax only applies to shareholders that are non-resident corporations.

Yes, they are entitled withholdings tax ranging from 10% to 37% depending on the counter and market.

(a) You are advised to check your account as payment is credited directly into your trust account.

(b) It could be due to the delay of issuing company as they have not released the payment.

We will notify you via email. Please ensure your email address is updated.

Yes, you are able to choose cash or scrip by giving instruction to your respective Dealer's representative.

Yes, you are still entitled for the dividend if you did not revert within the stipulated timeline; but it will be subjected to a default option.

No, share will be purchased on-market as soon as practicable after the dividend payment date by using the cash dividend that you are entitled.

Yes, you are allowed to amend your instruction within the stipulated timeline.

After the stipulated time, you are not allowed to amend your instruction.

You can contact your respective Dealer¡¯s Representative or call us at 03-2147 1888.

The amount provided by your DR is an estimation as the exact dividend charges will only be confirmed upon receiving the invoice from the counter broker.

Yes, you can. Please inform your Dealer's Representative that you would like to receive your dividend in MYR and they will let you complete an updating form to process the request.

UTRADE Rewards is a loyalty programme that rewards our clients with points for choosing UOB Kay Hian as their preferred broker.

It is our way of saying “Thank You” for making us your top choice every time you trade.

You can redeem an exciting range of rewards such as education, lifestyle, market depth, price feed, trade rebate and trading tools.

All UOB Kay Hian clients with any one or more of the following online accounts are eligible for the programme:

For every RM1 of brokerage paid to UOB Kay Hian, clients will be awarded with 1 reward point. All online and offline trades for Bursa and Foreign Markets will be awarded with reward points, provided that the trading account has online trading access. Reward points are awarded daily, and are rounded down to the nearest reward point.

Reward points earned by all eligible online trading accounts will be valid for up to two years. The expiry date of all rewards points are calculated from the date that it is credited.

Reward points earned on multiple eligible online trading accounts can be combined for redemption as long as accounts are all linked to one eligible master online trading account.

We are pleased to inform that you can make redemptions via our Reward page within UTRADE Web which is available 24 hours a day, seven days a week. The processing of redemptions will take effect on the next business day, depending on the type of reward.

Upon successful redemption, the corresponding reward points will be deducted from your account immediately.

| Subscription Services | Subscription Period | Subscription Fee |

| Bursa Malaysia 5 Market Depth | 12-month | RM12 |

| SGX Live Prices Level 1 | 1-month | SGD3 |

| SGX Live Prices Level 2 | 1-month | SGD20 |

| HKEX Live Prices Level 1 | 1-month | HKD120 |

| HKEX Live Prices Level 2 | 1-month | HKD200 |

| US Live Prices Level 1 | 1-month | USD3 |

Please contact our Dealer Representative/ E-Business Representative at +603 2147 1900 during operating hours for your assistance. Alternatively, you may come to any UOBKH Malaysia Branches. Payment of your preferred live price feed subscription will deduct from your trust account in every month. We will activate the service upon receiving your form and deduction has made from us.

To facilitate payment clearance, please allow a processing time of at least 3 working days. You will be notified via email/calls upon successful activation.

Please contact our Dealer Representative/ E-Business Representative at +603 2147 1900 during operating hours for your assistance.

e-Payment is a service offered by UOB Kay Hian Securities (M) Sdn Bhd (“UOBKH”) to its trading Clients which allows UOBKH to credit payment electronically to its client’s designated bank account. e-Payment include all sale proceeds, contra gains, credit withdrawal and any sum standing to credit in the client’s account. This is an optional service provided to UOBKH’s Client. Therefore we strongly encourage all of our valued Clients to sign up for this e-Payment service.

By signing up for e-Payment service, you would enjoy:

No. This service is only made available to individual and corporate trading Clients with sale proceeds denominated in MYR currency only. This service is not available to Margin Clients, Collaterised Clients, Institutional Clients and to contracts that is settled in foreign currency.

No. This is an extra service which is offered to UOBKH’s Clients without any fees/charges.

You can assign any of your existing active saving or current account held under your name or in the case of a joint account that has your name as one of the accountholders. While joint bank account is allowed, it is NOT encouraged and the trading client must be the primary holder of the joint bank account. It is your responsibility to ensure that you are the primary bank account holder to avoid payment failure.

The saving or current account must be maintained with one of the financial institution that is located in Malaysia and offers MEPS Inter-Bank GIRO (IBG) service. Part of the participating financial institutions that offers IBG services are Maybank, CIMB Bank, Hong Leong Bank, UOB Bank, HSBC Bank, Public Bank etc. For a complete list of financial institutions that offers IBG service, please refer to the following website.

Your bank account details and other related information will be used solely for the purpose of enabling payments to be credited directly into your bank account. It is protected under the Banking and Financial Institutions Act (BAFIA) 1989 that strictly prohibits the disclosure of such information to any person unless customer or his personal representative has given written permission. It should be noted that by signing the relevant form to provide your bank account information, you will be authorising the disclosure of your bank account information to parties’ necessary to effect a payment to you e.g. financial institutions.

No, you can register only one (1) bank account for your trading account with UOBKH.

You are required to complete the Customer Maintenance Update Form you can get a copy of the Form from our Customer Service or your Dealer’s Representative and submit back to UOBKH with the necessary supporting documents.

You have to provide a copy of the following supporting documents:

If you are using the same bank account that you sign up to receive e-Dividend, the supporting documents are waived.

UOBKH will activate the e-Payment service within three (3) business days upon receive of the completed prescribed form with all the supporting documents. For the avoidance of doubt, business day shall mean a day where UOBKH is open for business.

Payment will be made electronically into your designated bank account by UOBKH on T+2 if there are no outstanding losses or purchases. Generally, funds will be made available in your bank account within the same day of payment. However the actual timing may vary depending on the processes adopted by your designated bank.

Your bank will send an e-mail and/or sms informing you of the payment received from UOBKH.

Yes. There are 2 conditions that you should be aware of:

While it is unlikely to happen, e-Payment transaction may fail under the following circumstances, (not exhaustive):

If funds cannot be credited electronically into your bank account for reasons which may include but not limited to any of the abovementioned circumstances, UOBKH shall upon confirmation from its bank on the failed e-Payment transaction, contact you to validate your bank account details and/or rectify the mistake and thereafter credit back electronically your designated bank account the next day. Notwithstanding the above, UOBKH may at their discretion remit the payment to you via cheque in lieu of e-Payment.

Yes. You are allowed to change your designated bank account by completing the Customer Maintenance Update Form, with details of the new designated bank account and submit back to UOBKH together with a verified photocopy of the new designated bank account’s latest statement or passbook. No cost would be charged for this purpose.

Yes. You may request for payment via cheque on ad hoc basis by informing our Finance Department through your Dealer’s Representative on T+2 by 4.00 pm.

Yes. You can revoke the e-Payment service at any time by completing the Customer Maintenance Update Form and submit to UOBKH.

Yes. UOBKH has the right to revise, amend, vary and/or modify the e-Payment service and its terms and conditions at any time, without assigning any reasons and without any prior notice.

For more information about e-Share Payment, you can refer to Bursa Malaysia.

As contents on our website and system are constantly updated, we recommend that you adjust your browser cache settings to frequently check for the latest versions of stored webpages upon every visit to a page

Internet Explorer 6

Internet Explorer 7

Internet Explorer 8

If you did not logout properly, you will not be able to resume your login to your account immediately. Please call us at +603 2147 1900 to reset the procedure to resume logging in to your login. The system will also reset your login automatically after 5 minutes.

It is a trading account for clients to trade Shariah-compliant securities listed in Bursa Malaysia.

Anyone above 18 years old can open a Shariah trading account with us.

You may view the updated list of Shariah-compliant securities in Securities Commission website. There will also be an indicator in the Utrade platform for Shariah securities, indicated using the symbol °.

No, you will not be able to buy non-shariah compliant shares if you opened a Shariah trading account. The order keyed-in will be rejected by the system.

Yes, you may convert to Shariah trading account by submitting an account conversion form to your dealer representative. You can download the file here.

Yes, you may sell non-Shariah counters in your trading account.

Please refer to the link.